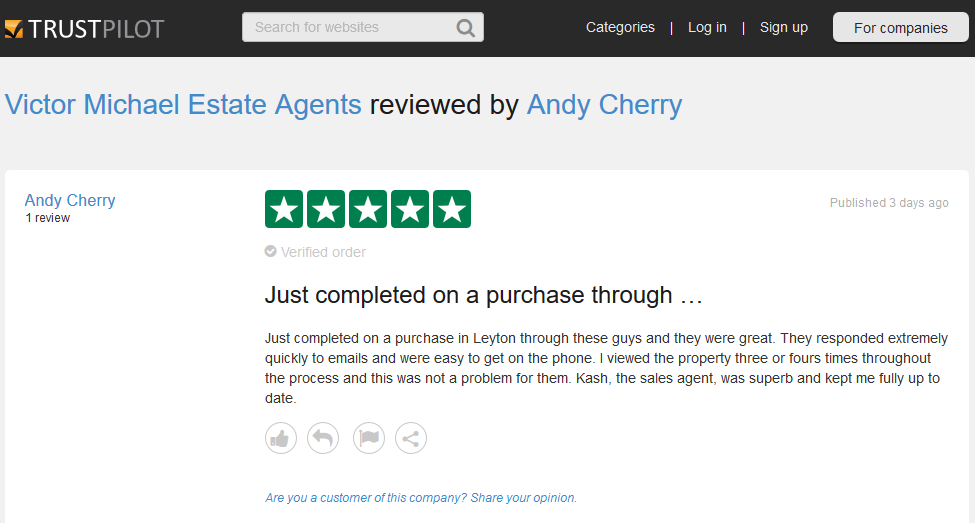

Location: Seymour Road, Leyton E10 7BL

Entrances: Marsh Lane, Seymour Road, Orient Way and Ive Farm Lane.

Nearest Stations: Leyton Central Line Station, Leyton Midland Station.

Buses: 48, 55, 56, 58, and 158.

When: 24 June, 12pm – 7pm

Where: Leyton Jubilee Park

Leyton Jubilee Park, the boroughs largest park, is now an outdoor sporting hub for the borough including, basketball court, mini and junior football pitches and a brand new changing pavilion.

Different from other events, the Summer Fest event is the only beer and sports festival where attendees can win prizes competing in free, entertaining events! There will be a series of matches and tournaments for you to watch and participate in.

- Watch “5 a side” girl’s football match. A number of local teams will be competing against each other to win the summer fest trophy. They also have volleyball matches and a rugby match.

- Fun and interactive traditional games such as target golf, putting contests, bean bag toss and more where attendees can compete to win prizes such as restaurant gift cards, free Fast Passes to the other events and much more!

- Mouth-watering creations from some of the top local food trucks.

- Kids Zone featuring fun creative activities and sports tester sessions.

If you’re one of those shopping for a house soon and you are considering a mortgage, you should carefully analyse a couple of factors before making a decision. The location, the time you are going to spend in your new home (if it is temporary or, hopefully, for the rest of your life), the purpose of the investment (for your own living or if it is a buy to let), and other life circumstances should be considered when choosing a type of mortgage.

If you’re one of those shopping for a house soon and you are considering a mortgage, you should carefully analyse a couple of factors before making a decision. The location, the time you are going to spend in your new home (if it is temporary or, hopefully, for the rest of your life), the purpose of the investment (for your own living or if it is a buy to let), and other life circumstances should be considered when choosing a type of mortgage. The mortgage market also seems to be improving since the number of completed applications for first time buyers is rising. 67% of first time mortgage applications were completed in the first quarter of 2017, up substantially from 48% in the same period of 2016. Intermediaries have eased up the applications because of the struggle to obtain a mortgage that was intensely publicised last year.

The mortgage market also seems to be improving since the number of completed applications for first time buyers is rising. 67% of first time mortgage applications were completed in the first quarter of 2017, up substantially from 48% in the same period of 2016. Intermediaries have eased up the applications because of the struggle to obtain a mortgage that was intensely publicised last year. Buying a home for the first time is one of the biggest decisions you will make.

Buying a home for the first time is one of the biggest decisions you will make.