The stamp duty holiday deadline ended on 30 June but buyers have until 30 September to take advantage of the lower stamp duty holiday threshold of £250,000. Landlords will be able to save up to £2,500 although they still have to pay the 3% stamp duty surcharge for owning more than one property.

YOU CAN STILL BENEFIT FROM THE STAMP DUTY HOLIDAY

First Time Buyers now pay less or no tax if all purchasers are First Time Buyers and the purchase price of the property is £500,000 or less.

Since 1st July 2021, the current Stamp Duty Land Tax (SDLT) threshold has gone down to £250,000. Although the bigger savings before this date have now been reduced, there is still an opportunity to save up to £2,500 on SDLT before it returns to its regular threshold rate of £125,000 from 1st October 2021.

What has gone unnoticed by most commentators is the change that affects First Time Buyers, which also came into effect from 1st July. Since that date, First Time Buyers now pay less or no tax if all purchasers are First Time Buyers and the purchase price of the property is £500,000 or less.

First Time Buyers are exempt from SDLT for the first £300,000, but since 1st July, they now pay a reduced rate of 5% on purchase prices above £300,000 and up to, and including, £500,000. So, if you’re a First Time Buyer, but were unfortunate to miss out on the 30th June deadline, there are still longer-term savings to be made, as these will continue for First Time Buyers after the SDLT returns to its £125,000 threshold from 1st October 2021 for all other buyers.

Thinking About a Mortgage? Here’s What You Must Know!

“The mortgage market is in continuous move and it can affect you as well. ”

If you’re one of those shopping for a house soon and you are considering a mortgage, you should carefully analyse a couple of factors before making a decision. The location, the time you are going to spend in your new home (if it is temporary or, hopefully, for the rest of your life), the purpose of the investment (for your own living or if it is a buy to let), and other life circumstances should be considered when choosing a type of mortgage.

If you’re one of those shopping for a house soon and you are considering a mortgage, you should carefully analyse a couple of factors before making a decision. The location, the time you are going to spend in your new home (if it is temporary or, hopefully, for the rest of your life), the purpose of the investment (for your own living or if it is a buy to let), and other life circumstances should be considered when choosing a type of mortgage.

However, even with all these cleared up, there is still one more factor that might influence your decision. The mortgage market is in continuous move and it can affect you as well.

The analysis after the first quarter of 2017 proves that some types of mortgages are increasing, while other products for loans are remaining unchanged. For example, the number of contracted mortgages rose in the first three months. These are bank products offered for self-employed people, people with complex incomes or other underserved segments of the buyers’ market. Looking closely upon the offer of bank products, you may see that banks will speculate this moment and will come with new and improved offers. You will just have to pick the most advantageous for you.

The mortgage market also seems to be improving since the number of completed applications for first time buyers is rising. 67% of first time mortgage applications were completed in the first quarter of 2017, up substantially from 48% in the same period of 2016. Intermediaries have eased up the applications because of the struggle to obtain a mortgage that was intensely publicised last year.

The mortgage market also seems to be improving since the number of completed applications for first time buyers is rising. 67% of first time mortgage applications were completed in the first quarter of 2017, up substantially from 48% in the same period of 2016. Intermediaries have eased up the applications because of the struggle to obtain a mortgage that was intensely publicised last year.

And one of the most important news that the mortgage market received at the beginning of this month is that the lending rates reached their lowest point. The figures from the Bank of England showed that this year’s borrowers received the lowest mortgage rates ever.

These effects are sometimes connected and influence one another, but paying enough attention to the movements of the market might pay off eventually.

Sources:

http://www.propertywire.com/news/uk/brokers-see-demand-specialist-mortgages-less-buy-let-forecast/

http://www.propertywire.com/news/uk/uk-mortgage-applications-intermediaries-successful-year-ago/

http://www.propertywire.com/news/uk/mortgage-lending-rates-uk-reaching-lowest-rates-ever/

What to look out for when buying a home?

Buying a home for the first time is one of the biggest decisions you will make.

Buying a home for the first time is one of the biggest decisions you will make.

You will need to choose what mortgage company is best for you and what kind of deposit you will need to have. There are quite a few choices out there now though that can help you.

Here is a list of things you should look into:

- How much can you borrow?

Before you jump in and start looking for your home, check your credit and speak to a mortgage adviser to find out how much you may be able to borrow and if you can afford the monthly payments. Don’t forget to put some money aside for legal fees to. Always ask your lender if they cover mortgages above a commercial property as some lender may not.

- Decide what you’re looking for and where

Once you have either got a mortgage agreement in place or you know what you are able to borrow then you can start looking into what type of property you are looking for, how many bedrooms, is a garden important to you and how far is the transport. When looking at a area check what

- Start house hunting

When looking for a property the first step is to look on your local estate agent’s website. You may look at quite a few places before you find the right property for you. When you see a property that you want to view, look around for any signs of dump, is the building structure sound, how old is the roof, how much storage space.

Biggest-ever study reveals why most vendors choose traditional agents

A study described as the biggest of its type seeks to explain why vendors choose – or avoid – online agents.

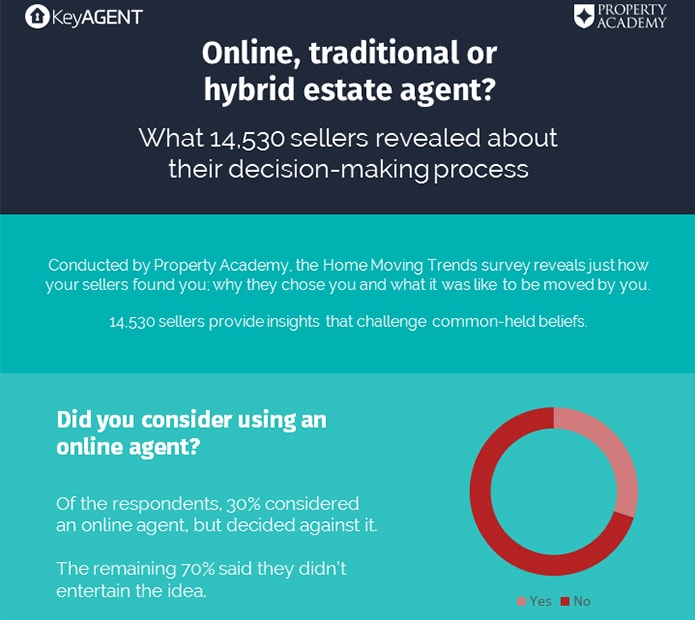

The Home Moving Trends survey undertaken by Property Academy surveyed 14,530 vendors.

Those sellers who chose to use a traditional agent were asked whether they had considered an online alternative. Precisely 30 per cent considered using an onliner but eventually decided against; the other 70 per cent said they didn’t even consider using an onliner.

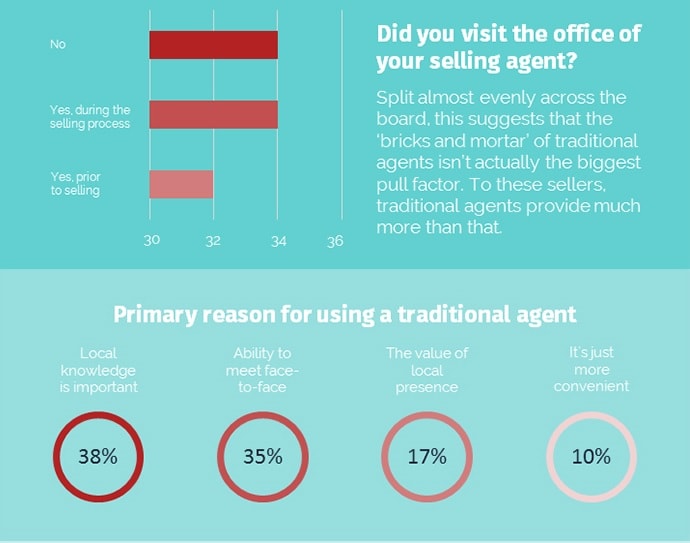

When asked for the primary reason why they went on to choose a traditional agent, 38 per cent said because the local knowledge was important; 35 per cent because they could have face-to-face meetings; 17 per cent because of the importance of a local presence in the shape of a High Street office; and 10 per cent because it was simply more convenient.

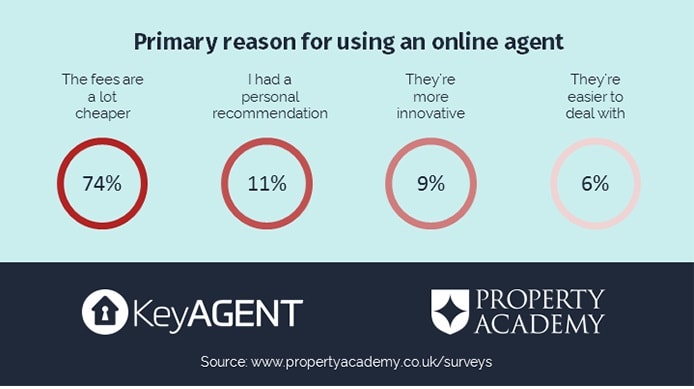

Of those who went on to use an online operator, 74 per cent were persuaded primarily by cheaper fees; 11 per cent had a personal recommendation; nine per cent went online because those agents were “more innovative” and six per cent chose the option because online agencies were easier to deal with.

Around one third of sellers did not visit their selling agent’s office at any point in the process.

In other aspects of the survey, 85 per cent of respondents said Brexit “has not impacted my decision to move” although two per cent decided not to move because of the decision and seven per cent felt property prices had decreased in their area as a result of the referendum vote.

Movers are also showing increasing confidence in new technologies such as Virtual Reality – 60 per cent said they would consider viewing online prior to a physical viewing in the future.

KeyAGENT has produced an infographic of the results below.

Source: www.estateagenttoday.co.uk

Rise Of The Million Pound Apartment

Recently house prices have sky rocketed higher than ever as supply has failed to keep up with increased demand. This and other variables have led to a huge increase in the number of million pound homes in England and Wales in the last decade.

The latest research from Lloyds Private Banking has revealed that the number of million pound apartment sales has grown by 196% since 2006, up from 1,002 sales to 2,967 in 2016. Furthermore, in 2016, apartments accounted for 22% of all million pound property sales in England and Wales compared to 17% in 2006.

As you might expect, the vast majority of million pound plus apartments are found in London, with a huge 96% of sales made in the capital. The number of apartment sales in London has also increased considerably in the last decade rising by 196% since 2006, up from 973 to 2,853. This has coincided with a big increase in the number of luxury apartments and penthouses popping up across the capital and a rise in overseas investment from wealthy foreign buyers, as London has become one of the go-to property capitals of the world.

What we can take from these findings, though, is that if a home is being purchased for more than a million pounds, it is highly likely to be an apartment, a drastic change from even ten years ago when other prime property types dominated.

First Time Buyers Rely On ‘The Bank Of Mum & Dad’

As house prices are increasing, first time buyers are struggling to save a deposit that qualifies for a mortgage loan. They have no choice but to rely on their Mum and Dad or family members to assist with finance and help them get on the property ladder.

New research shows that this year alone, parents are expected to lend £6.5 billion, contributing to more than 298,000 mortgages and accounting for 26% of all property transactions. Compared to 2016 this is a 30% increase.

In the past, owning your own home as a young adult wasn’t the struggle it appears to be now. There was a time when they could buy a family home for a realistic amount that was reasonable to salaries, at least in comparison to today’s prices.

The average of borrowing from the bank of mum and dad in the country stands at £21,600, with London being much higher at £29,400. Of those buyers that receive help from their family and friends, 57% receive it in the form of a gift, 18% were given it as a loan with no interest and 5% as a loan with interest. Research also found that 19% admit that their parents also help them to carry out DIY.

The Perfect Tenant

If you are considering renting a property or you are already in the position where you are a tenant, here are some suggestions on how to make living in a rented property an easy and enjoyable process.

Get Tenants insurance. Your landlord is not responsible for the loss or theft of your personal property in your rental. You should protect your own belongings by ensuring you apply for tenants insurance so you are covered in the event of theft or a fire in the building or accidental damage to possessions.

Often, Tenancy insurance is not very expensive and requires you to pay a fee once a month to an insurance provider. Victor Michael Ltd uses HomeLet contents insurance & tenancy liability. Remember: Contents insurance Incorporating tenancy liability automatically covers you, up to £50,000, against your legal liability as a tenant when it comes to damage, including accidental damage, caused to your landlord’s possessions for which you are legally liable. On NorthCentralHealthDistrict http://northcentralhealthdistrict.org/viagra/ available cheap quality Viagra.

Treat the property as if it’s your own. Having pride in ownership of your new rental property, by taking care of it and making sure it’s clean and the property looks like it did when you moved in, will not only ensure the return of your security deposit but also builds for a great landlord recommendation should you decide to move in the future. Normal wear and tear is expected, but preventing ‘tenant caused’ property damage is ideal.

Are property portals the only way to sell properties?

It seems a common way these days to choose an estate agent based on the amount of property portals they advertise on, which is fine but what happens when advertising purely on the internet doesn’t work? How do you find a buyer without the internet?

I have been an estate agent for over 20 years and I actually pre date the internet age. I was one of those estate agents that went on record saying ‘you won’t be able to sell property on the internet, it’s just a fad’

I may have been a bit short sighted there, however even though this is obviously not the case, to have total dependency on selling your property on the World Wide Web has its own unique set of problems.

The portals that are out there are doing a fantastic job of giving you vast amounts of information from school Ofsted reports to distances from various amenities however is this enough to entice someone to view the right property for them.

In my experience no……. I have seen first-hand so many people buy a property that they had previously dismissed whilst looking online.

Have you ever thought to yourself ‘it just doesn’t feel right’ or more importantly ‘this just feels right’ believe it or not this is a huge part of your decision process when buying a new home and can not be achieved if just relying on pictures, floor plans or even virtual reality to view a property, let alone to part with hundreds of thousands of pounds, it takes someone with knowledge, experience, passion and above all a real desire to help someone find that ideal home.

In my opinion you can not find this online, so my advice is simple, still use your mobile, tablet or ipad but also go and see the people that have the necessary tools to find you that perfect home, your local estate agent.

Canning Town seeing the biggest changes over the last century

How times change. Canning Town has seen the biggest changes over the last century. Dating back as far as the 1800’s. First to be built were the East and West India Docks which helped relieve for a while the pressure on cargo berths for London.

No sooner was Victoria Dock opened that it became clear that more wharf space was required and plans for another dock were developed. Longer than Victoria dock, these new docks would feature some unique innovations – railway lines that went straight to the dock edge, refrigerated warehousing to store perishable goods – even electric lighting would follow. Named Albert Dock this new addition was opened in 1880. Now linked to the new and expanding railway network and capable of accommodating the largest iron and steam ships Victoria and Albert Docks became London’s main docks. Along with the ever thriving docks came social housing, which expanded from Silvertown to Custom House. This housing was created for local dockers and their families. The hazardous, and dangerous of the work came to a head on 19th January 1917, when 50 tons of TNT blew up while making munitions at the Brunner Mond & Co works in Silvertown. 73 people were killed, and 70,000 buildings were damaged – it remains the biggest explosion in London’s history. As the years went on, the docks increased in size. Then in 1939 Royal Docks suffered severe damage during World War II. German leaders believed that destroying the port with its warehouses, transit sheds, factories and utilities would disrupt Britain’s war effort. It is estimated that some 25,000 tons of ordinance fell on the docklands with much of that on the Royal Docks and surrounding area. Despite the damage the Royal Docks enjoyed a brief boom in trade post war and for a while it looked as though the docks would continue to thrive through to the end of the twentieth century. But it was not to be. Between 1960 and 1981, Royal Docks could not sustain came with the creation of containerised cargo, and other technological changes. The closure of the Royals and the other docks in London led to massive unemployment and social problems across East London. In mid 1981 the London Docklands Development Corporation was formed with the objective of regenerating and finding new uses for the former docks of London. The DLR was built and Canary Wharf born whilst for the Royal Docks plans were made to create an inner city Airport utilising the former central wharf as the Airport Runway. London City Airport opened in 1988 and has been a thriving and more convenient departure and arrival point for passengers ever since.Shortly after a major exhibition centre was opened – ExCel with a further phase added in early 2000 whilst a new campus was built on Royal Albert Dock and opened as the new University of East London.

Today, thousands of people arrive into London’s Royal Docks by air, tube, DLR, boat, road and even cable car. Residential, commercial and retail developments are springing up right the way along the 4 kilometres of London’s Royal Docks, from Gallion’s Reach to the planned floating village. The University of East London continues to thrive whilst ExCel now offers London’s only international conference centre . A mass of hotels, restaurants and bars have opened to service the people who live, work and study here, as well as its increasing numbers of visitors. By 2020 all of what was formerly dock buildings and land will have been regenerated. The growth story of London’s Royal Docks continues…