The stamp duty holiday deadline ended on 30 June but buyers have until 30 September to take advantage of the lower stamp duty holiday threshold of £250,000. Landlords will be able to save up to £2,500 although they still have to pay the 3% stamp duty surcharge for owning more than one property.

YOU CAN STILL BENEFIT FROM THE STAMP DUTY HOLIDAY

First Time Buyers now pay less or no tax if all purchasers are First Time Buyers and the purchase price of the property is £500,000 or less.

Since 1st July 2021, the current Stamp Duty Land Tax (SDLT) threshold has gone down to £250,000. Although the bigger savings before this date have now been reduced, there is still an opportunity to save up to £2,500 on SDLT before it returns to its regular threshold rate of £125,000 from 1st October 2021.

What has gone unnoticed by most commentators is the change that affects First Time Buyers, which also came into effect from 1st July. Since that date, First Time Buyers now pay less or no tax if all purchasers are First Time Buyers and the purchase price of the property is £500,000 or less.

First Time Buyers are exempt from SDLT for the first £300,000, but since 1st July, they now pay a reduced rate of 5% on purchase prices above £300,000 and up to, and including, £500,000. So, if you’re a First Time Buyer, but were unfortunate to miss out on the 30th June deadline, there are still longer-term savings to be made, as these will continue for First Time Buyers after the SDLT returns to its £125,000 threshold from 1st October 2021 for all other buyers.

Discussed Price Freeze for the Housing Market

Photo source: Pixabay

http://bit.ly/2oOyurQ

Measurements to improve affordability for UK houses could include a price freeze for the next five years. This is the main suggestion made by think tank IPPR, the Institute for Public Policy Research, to the Bank of England.

Think tank urges government to introduce five-year house price freeze

The reason is logical and the phenomenon has been happening visibly on the house market lately: easy lending options (offered by banks) influence the house prices. Prices rise and potential buyers need more money… lent from banks. This is a cycle that will keep on repeating itself. Unless the Treasury decides to stop prices from rising.

However, these measures will have a big impact on every potential buyer, but especially on first-time buyers. Details on the article on Property Reporter.

Global Buyers Like Marylebone

The report explains that Marylebone has been transformed by a wave of new residential development, providing over 450 new homes, which has created a three tier property market and as a result the area has joined adjacent Mayfair as one of London’s most highly sought after addresses.

The Natural Development of the UK Property Market

Photo source: Property Reporter http://bit.ly/2wICfB5

Taken individually, these moves we hear about on the property market seem to be weird and with no rational basis: ‘biggest fall since…’, ‘highest raise’, etc. But if you judged them in the context of the market as a whole they make perfect sense.

For example, home buyers have been increasingly attracted by discounted luxury property. They now count for 45% of all purchases in prime central London. As an effect, the number of investors in buy to let (BTL) has seen a significant decrease, falling by 1/3.

Since luxury homes are the main target for the demand, the natural outcome is that the number of flat sales to fall easily. And this is exactly what has happened since the beginning of this year: flat sales went down 11% and prices have increased by 2.6%.

If you want to understand all the effects and, more important, the causes of the effects happening on the property market in the UK read the full analysis on Property Reporter:

Who is buying up Central London?

Thinking About a Mortgage? Here’s What You Must Know!

“The mortgage market is in continuous move and it can affect you as well. ”

If you’re one of those shopping for a house soon and you are considering a mortgage, you should carefully analyse a couple of factors before making a decision. The location, the time you are going to spend in your new home (if it is temporary or, hopefully, for the rest of your life), the purpose of the investment (for your own living or if it is a buy to let), and other life circumstances should be considered when choosing a type of mortgage.

If you’re one of those shopping for a house soon and you are considering a mortgage, you should carefully analyse a couple of factors before making a decision. The location, the time you are going to spend in your new home (if it is temporary or, hopefully, for the rest of your life), the purpose of the investment (for your own living or if it is a buy to let), and other life circumstances should be considered when choosing a type of mortgage.

However, even with all these cleared up, there is still one more factor that might influence your decision. The mortgage market is in continuous move and it can affect you as well.

The analysis after the first quarter of 2017 proves that some types of mortgages are increasing, while other products for loans are remaining unchanged. For example, the number of contracted mortgages rose in the first three months. These are bank products offered for self-employed people, people with complex incomes or other underserved segments of the buyers’ market. Looking closely upon the offer of bank products, you may see that banks will speculate this moment and will come with new and improved offers. You will just have to pick the most advantageous for you.

The mortgage market also seems to be improving since the number of completed applications for first time buyers is rising. 67% of first time mortgage applications were completed in the first quarter of 2017, up substantially from 48% in the same period of 2016. Intermediaries have eased up the applications because of the struggle to obtain a mortgage that was intensely publicised last year.

The mortgage market also seems to be improving since the number of completed applications for first time buyers is rising. 67% of first time mortgage applications were completed in the first quarter of 2017, up substantially from 48% in the same period of 2016. Intermediaries have eased up the applications because of the struggle to obtain a mortgage that was intensely publicised last year.

And one of the most important news that the mortgage market received at the beginning of this month is that the lending rates reached their lowest point. The figures from the Bank of England showed that this year’s borrowers received the lowest mortgage rates ever.

These effects are sometimes connected and influence one another, but paying enough attention to the movements of the market might pay off eventually.

Sources:

http://www.propertywire.com/news/uk/brokers-see-demand-specialist-mortgages-less-buy-let-forecast/

http://www.propertywire.com/news/uk/uk-mortgage-applications-intermediaries-successful-year-ago/

http://www.propertywire.com/news/uk/mortgage-lending-rates-uk-reaching-lowest-rates-ever/

What to look out for when buying a home?

Buying a home for the first time is one of the biggest decisions you will make.

Buying a home for the first time is one of the biggest decisions you will make.

You will need to choose what mortgage company is best for you and what kind of deposit you will need to have. There are quite a few choices out there now though that can help you.

Here is a list of things you should look into:

- How much can you borrow?

Before you jump in and start looking for your home, check your credit and speak to a mortgage adviser to find out how much you may be able to borrow and if you can afford the monthly payments. Don’t forget to put some money aside for legal fees to. Always ask your lender if they cover mortgages above a commercial property as some lender may not.

- Decide what you’re looking for and where

Once you have either got a mortgage agreement in place or you know what you are able to borrow then you can start looking into what type of property you are looking for, how many bedrooms, is a garden important to you and how far is the transport. When looking at a area check what

- Start house hunting

When looking for a property the first step is to look on your local estate agent’s website. You may look at quite a few places before you find the right property for you. When you see a property that you want to view, look around for any signs of dump, is the building structure sound, how old is the roof, how much storage space.

Biggest-ever study reveals why most vendors choose traditional agents

A study described as the biggest of its type seeks to explain why vendors choose – or avoid – online agents.

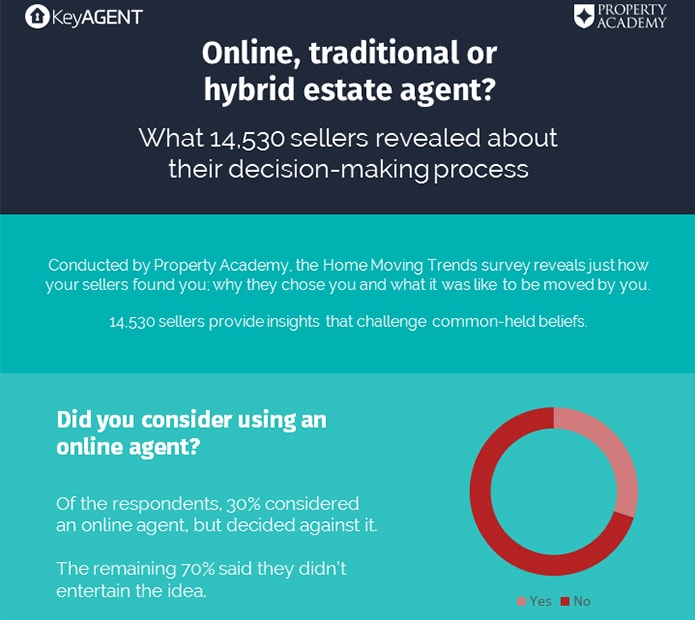

The Home Moving Trends survey undertaken by Property Academy surveyed 14,530 vendors.

Those sellers who chose to use a traditional agent were asked whether they had considered an online alternative. Precisely 30 per cent considered using an onliner but eventually decided against; the other 70 per cent said they didn’t even consider using an onliner.

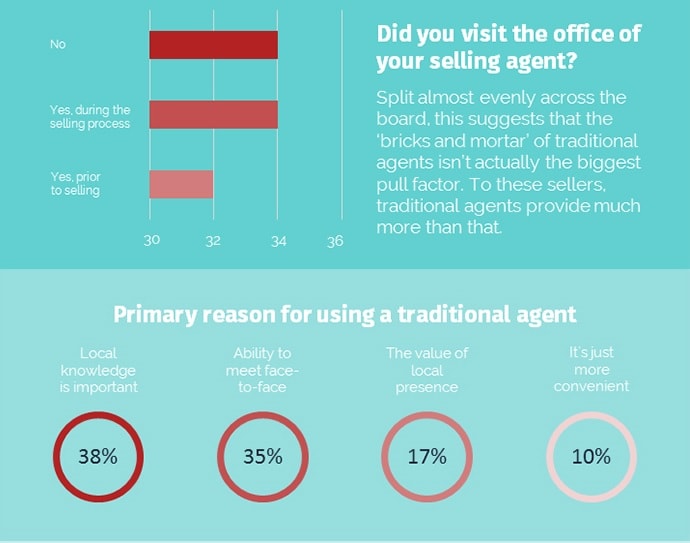

When asked for the primary reason why they went on to choose a traditional agent, 38 per cent said because the local knowledge was important; 35 per cent because they could have face-to-face meetings; 17 per cent because of the importance of a local presence in the shape of a High Street office; and 10 per cent because it was simply more convenient.

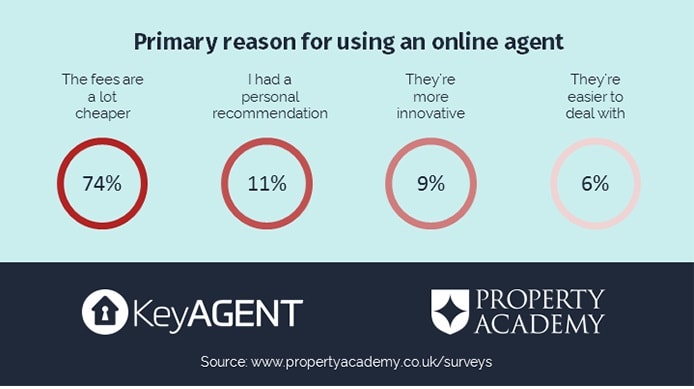

Of those who went on to use an online operator, 74 per cent were persuaded primarily by cheaper fees; 11 per cent had a personal recommendation; nine per cent went online because those agents were “more innovative” and six per cent chose the option because online agencies were easier to deal with.

Around one third of sellers did not visit their selling agent’s office at any point in the process.

In other aspects of the survey, 85 per cent of respondents said Brexit “has not impacted my decision to move” although two per cent decided not to move because of the decision and seven per cent felt property prices had decreased in their area as a result of the referendum vote.

Movers are also showing increasing confidence in new technologies such as Virtual Reality – 60 per cent said they would consider viewing online prior to a physical viewing in the future.

KeyAGENT has produced an infographic of the results below.

Source: www.estateagenttoday.co.uk

First Time Buyers Rely On ‘The Bank Of Mum & Dad’

As house prices are increasing, first time buyers are struggling to save a deposit that qualifies for a mortgage loan. They have no choice but to rely on their Mum and Dad or family members to assist with finance and help them get on the property ladder.

New research shows that this year alone, parents are expected to lend £6.5 billion, contributing to more than 298,000 mortgages and accounting for 26% of all property transactions. Compared to 2016 this is a 30% increase.

In the past, owning your own home as a young adult wasn’t the struggle it appears to be now. There was a time when they could buy a family home for a realistic amount that was reasonable to salaries, at least in comparison to today’s prices.

The average of borrowing from the bank of mum and dad in the country stands at £21,600, with London being much higher at £29,400. Of those buyers that receive help from their family and friends, 57% receive it in the form of a gift, 18% were given it as a loan with no interest and 5% as a loan with interest. Research also found that 19% admit that their parents also help them to carry out DIY.

Questions that first time buyers should be asking before they purchase their first home

Buying your first home will be exciting, but it is important to stay grounded and focus on some important factors. Victor Michael look at the questions that first- time buyers should be asking before they purchase their first home.

Buying your first home is a very exciting time, and can also be a stressful one. Preparation is key in overcoming concerns and worries in order to make the process as painless as possible.

Victor Michael have compiled a list of questions to ask during the buying process that will hopefully help you on your way. It could mean the difference between buying your dream home or buying a disaster.

How much can I afford ? This, in itself can be a daunting task, but a task that needs to be assessed before you can look at any properties. The mortgage application is as important as the property. It is advisable to speak to a few brokers, just to ensure that you are getting the best quote to find out how much you can afford. Once you have a “ decision in principle” you can start your search for properties in your price range.

Would I be happy here long term ? When searching for your new home, don’t compromise on location just to get on the ladder. Remember that you have to live there, so make sure you explore all your options. Make a wish list of the amenities that you need close by – the way you live is key to deciding on a location. Think about what you do when you come home from work, this can help you really determine if proximity to a gym, train station, park or good restaurants matter

Why are they selling ? While agents or sellers don’t have to answer this question it’s always good to get a good idea of the property’s history, and why the current owners have decided to move on. You might find out that the owner has work that is taking them overseas and therefore is keen to sell quickly, and so would accept a lower price.

Which survey do I need ? This is an important factor for any purchaser. This will ensure that the property is in good shape. Taking out a home buyers survey will avoid any stress later down the line – so be sure to undertake this task.

Exactly what is included in the sale. ? Ask questions ! Do not be afraid to ask. No matter how silly you think it sounds. If you see an item of furniture that sets the property off, ask if there is a possibility it could be included.

Has the property repeatedly changed hands ? Try to find out ? Speak to neighbours, shop keepers, anyone that may know. If the property has repeatedly changed hands In the last 10 years, this could be an indication that something is wrong. Be realistic, and keep an open mind.

How much is the council tax and how much are the utility bills in this area ? If you can, try to get exact amounts, talk to the seller if you need to, these costs need to be added to your overall budget. While these may seem like small considerations in comparison to the amount you will spend on the house, they are reoccurring expenses that will add to the pressure of owning your own home.

Do you have noisy neighbours ?If the seller has lodged any complaints against their neighbours they legally have to tell you if you ask – so make sure to ask this one, it could save you a lot of trouble! It may be worth visiting the area at night just as a precautionary measure.