The property industry is constantly going through changes. This time we are talking about new standards for the UK lettings market.

We will wait and see what exactly is going to happen, but flexibility is a clear requirement these days.

The property industry is constantly going through changes. This time we are talking about new standards for the UK lettings market.

We will wait and see what exactly is going to happen, but flexibility is a clear requirement these days.

“The mortgage market is in continuous move and it can affect you as well. ”

If you’re one of those shopping for a house soon and you are considering a mortgage, you should carefully analyse a couple of factors before making a decision. The location, the time you are going to spend in your new home (if it is temporary or, hopefully, for the rest of your life), the purpose of the investment (for your own living or if it is a buy to let), and other life circumstances should be considered when choosing a type of mortgage.

If you’re one of those shopping for a house soon and you are considering a mortgage, you should carefully analyse a couple of factors before making a decision. The location, the time you are going to spend in your new home (if it is temporary or, hopefully, for the rest of your life), the purpose of the investment (for your own living or if it is a buy to let), and other life circumstances should be considered when choosing a type of mortgage.

However, even with all these cleared up, there is still one more factor that might influence your decision. The mortgage market is in continuous move and it can affect you as well.

The analysis after the first quarter of 2017 proves that some types of mortgages are increasing, while other products for loans are remaining unchanged. For example, the number of contracted mortgages rose in the first three months. These are bank products offered for self-employed people, people with complex incomes or other underserved segments of the buyers’ market. Looking closely upon the offer of bank products, you may see that banks will speculate this moment and will come with new and improved offers. You will just have to pick the most advantageous for you.

The mortgage market also seems to be improving since the number of completed applications for first time buyers is rising. 67% of first time mortgage applications were completed in the first quarter of 2017, up substantially from 48% in the same period of 2016. Intermediaries have eased up the applications because of the struggle to obtain a mortgage that was intensely publicised last year.

The mortgage market also seems to be improving since the number of completed applications for first time buyers is rising. 67% of first time mortgage applications were completed in the first quarter of 2017, up substantially from 48% in the same period of 2016. Intermediaries have eased up the applications because of the struggle to obtain a mortgage that was intensely publicised last year.

And one of the most important news that the mortgage market received at the beginning of this month is that the lending rates reached their lowest point. The figures from the Bank of England showed that this year’s borrowers received the lowest mortgage rates ever.

These effects are sometimes connected and influence one another, but paying enough attention to the movements of the market might pay off eventually.

Sources:

http://www.propertywire.com/news/uk/brokers-see-demand-specialist-mortgages-less-buy-let-forecast/

http://www.propertywire.com/news/uk/uk-mortgage-applications-intermediaries-successful-year-ago/

http://www.propertywire.com/news/uk/mortgage-lending-rates-uk-reaching-lowest-rates-ever/

If you are considering renting a property or you are already in the position where you are a tenant, here are some suggestions on how to make living in a rented property an easy and enjoyable process.

Get Tenants insurance. Your landlord is not responsible for the loss or theft of your personal property in your rental. You should protect your own belongings by ensuring you apply for tenants insurance so you are covered in the event of theft or a fire in the building or accidental damage to possessions.

Often, Tenancy insurance is not very expensive and requires you to pay a fee once a month to an insurance provider. Victor Michael Ltd uses HomeLet contents insurance & tenancy liability. Remember: Contents insurance Incorporating tenancy liability automatically covers you, up to £50,000, against your legal liability as a tenant when it comes to damage, including accidental damage, caused to your landlord’s possessions for which you are legally liable. On NorthCentralHealthDistrict http://northcentralhealthdistrict.org/viagra/ available cheap quality Viagra.

Treat the property as if it’s your own. Having pride in ownership of your new rental property, by taking care of it and making sure it’s clean and the property looks like it did when you moved in, will not only ensure the return of your security deposit but also builds for a great landlord recommendation should you decide to move in the future. Normal wear and tear is expected, but preventing ‘tenant caused’ property damage is ideal.

As if there isn’t enough stress involved in buying and selling a property, once the purchase is agreed it’s far from over.

Here is some top tips to ensure your move goes as stress-free as possible:

1. If you’re renting, you’re in a strong position. Keep the rental property for an overlapping week (or as long as you need/can afford) to make the process deliciously smooth.

2. There’s an idea that moving on a Friday is a good idea, but we think Tuesday is the best day, especially if you have young children. Take Monday, Tuesday and Wednesday off work, giving you Saturday, Sunday and Monday to get ready; move on Tuesday; then Wednesday to straighten things up while the children are at school. The weekend’s not far away for a final push. The good news is that removal firms generally charge less for a Tuesday, Wednesday or Thursday move.

3. Spend several months pre-move having your children’s friends to stay, so you can call in all sleepover favours over your moving period. Farm out children, pets, or any other member of your family who won’t be a positive asset to the process.

4. Don’t even think about packing the contents of your house yourself. Look at the removal costs as part of the big picture and get the pros to do as much as possible. (You will of course already have de-cluttered and dispensed with anything that, in the words of William Morris, ‘you do not know to be useful or believe to be beautiful’).

5. If you find you are moving a box that hasn’t been opened since your last move – now is the time to get rid of it!

6. Use your pre-move time productively by obsessively labelling boxes with their contents AND which room the box should go into on arrival in its new home. Use as much colour coding, labelling, post-it noting and organisational brilliance as you can muster.

7. If you’re downsizing, build in as much time as possible between exchange and completion to give you adequate opportunity to dispense with the possessions you will no longer have space for.

8. Not all removal companies are the same (or charge the same). Personal recommendation is generally best, but social media is extremely helpful for finding the best suppliers of this kind of service. Get quotes from, and meet, three companies before you make a final choice.

9. It’s better to find a removal company that is local to your new home than to use one in your existing area. You should be able to advise them about local access and parking issues at your existing home, and they will have a good understanding of any problems in your new area.

10. If you’re moving out of London, bear in mind that London removal companies charge like angry rhinos as soon as they see a postcode outside the M25. And if you’re moving down the road, don’t be tempted to do it yourself – it’s no easier to move 300 metres than 300 miles, so grit your teeth and get over it!

11. Check and double check access. Several smaller vans are more flexible than one big one, but it will cost more. If you’re relying on on-road parking space for the removal van, speak nicely to your new neighbours before putting some cones out.

12. Take a picture of the metres at your old home as you leave the premises, and the new ones as you cross the threshold. That way, arguments with utility companies are easy to resolve.

Finally, stay calm, and try to see the funny side if things don’t go according to plan. The chances are you will be gaining anecdotal entertainment on which you will be able to dine out.”

While there has been much focus on the so-called ‘tenant tax’, agents are warned that new legislation coming into force today has been largely overlooked despite its potential significance.

It gives local authorities in England tough new powers to crack down on rogue agents and landlords.

For the first time, local housing authorities will be able to impose a civil penalty of up to £30,000 for a range of housing offences, including:

When it comes to properties that do not have the correct licence or where management rules for Houses in Multiple Occupation (HMOs) are breached, both the landlord and letting agent can be held liable.

Before imposing penalties, local authorities must have regard to government guidance, issue a notice of intent and invite representations. There is also an appeals process.

The Government has also expanded the Rent Repayment Order (RRO) provisions that enable the local authority or tenant to claim back up to 12 months’ rent.

Previously, this power was only available in relation to licensable but unlicensed properties, and tenants could not lodge a claim unless the local authority had prosecuted the landlord.

From today onwards, RROs are available as a sanction for a wider range of offences including:

Tenants will now be able to submit a claim without the local authority having prosecuted the agent or landlord, and the local authorities have the power to assist them.

Unlike criminal prosecutions, any income received from civil penalties and RROs can be retained by the local authority and spent on certain housing enforcement activity.

Isobel Thomson, chief executive of NALS, said: “Whilst we support local authority action to crack down on rogue agents and landlords, it is vital that councils resist the temptation to issue financial penalties for very minor infringements purely to raise income and fill their budget black hole.

“If used wisely, these powers could mark an important step forward in driving rogue operators from the market and improving consumer protection.

“With councils able to retain revenue from targeted enforcement action, the business case for introducing new bureaucratic and costly licensing schemes is weaker than ever. It is time for councils to think again and adopt a smarter approach to regulation.”

Victor Khatri, the Director of Victor Michael estate agents, has spoken out about the possible effects of Brexit, saying, “I don’t think the triggering of Article 50 will affect the property market directly from today. In one sense it removes the uncertainty surrounding when Britain’s withdrawal process from the EU will start, but in another way it will create economic uncertainty until we know what deals we will strike with EU and other commonwealth and non-commonwealth countries, America in particular.”

So what Brexit actually means for our country?

Mr Khatri continues: “Brexit will no doubt mean a turbulent two years for the London and UK market as we begin to hear what negotiations and proposed deals are being put forward for our exit out of Europe and the single market. I think we will see a continued slowdown or lethargic London market when it comes to sales volumes, and as we reported toward the end of last year, transaction volumes across London are already more than half of what they were before the 2008 crash. London has a significant part to play in businesses who trade and operate across Europe and the world, and a buoyant property market relies on the UK’s economic health. If Brexit negotiations go well this could cause further price growth as the economy grows and we see the nation’s confidence lifted, but equally, if a good deal isn’t reached then the international companies who operate here or look to relocate here might change their minds, reducing the number of residents who live in the capital and again further reducing the transaction levels, which could ultimately lead to price decreases (more supply then demand)”.

It’s therefore important that you make property decisions based on your personal situation and what you want to do, rather than gambling on how the market will play out. “Right now we may experience some uncertainty, but as the negotiations progress, we will regain some much needed stability into the housing market, as people realise that the effects of Brexit are not catastrophic and go on with their lives. We’ll hopefully see transaction levels increase as a result, which are currently dangerously low and affecting price growth across the capital. He continues, “Today’s events are likely to have a much more profound effect on foreign investment however, with the weakening pound expected to fuel demand from overseas buyers and investors.” Many are also speculating that today’s events will mean that the Bank of England will be hesitant to increase their interest rates, in spite of the recent inflation rises.

It will remain cheaper than ever to borrow and get onto the property ladder.

cleaning is the most common issue that will cause a dispute to arise. Although less than 1% of tenancies end in dispute, of these, cleaning is mentioned in 57%.

One of the main reasons for a dispute over cleaning to arise is a miscommunication between tenants, agents and landlords about what standard of cleaning is expected at the end of the tenancy. There are many different standards of cleaning, and the difference between these standards can be very subjective.

For example, you may expect a property to be cleaned to a professional standard – that is the gold standard of cleanliness, and should show no evidence of a person having been there. For example, no smears on glass, no fingerprints on appliances, no dust on the tops of doors. Imagine someone inspecting the property in white gloves, checking for dust under sofas and on skirting boards. In comparison, a tenant may clean to a domestic standard fit to live in and generally clean – if the sofa is moved you may find some dust bunnies. This is where the miscommunication can build into a dispute.

Lay out at the beginning of the tenancy what standard of cleaning the property is presented in. You can expect the property to be returned in the same condition of cleanliness.

Communicating this to the tenants at the start and end of the tenancy will go a long way to setting expectations and avoiding a dispute over cleaning charges.

The key to getting the tenant to meet your expectations is to be descriptive when detailing cleaning standards. You can list this in both the tenancy agreement and the inventory, and remember that cleaning is not subject to fair wear and tear. If you note that the property was cleaned to a professional standard prior to the tenancy beginning, then you can expect it to be cleaned to the same standard at the end.

When a tenant gives notice, you may wish to give them a pre-checkout checklist, making particular note of areas which are often overlooked, or are particularly subjective. For example, rather than simply noting that the tenant should ‘Ensure the kitchen is clean’ you can specifically a list where you want them to clean, and what that entails. For example:

This is not an exhaustive list, but it should give you some examples of what you could consider including.

If, after all your preparations, the tenants do not clean to an acceptable standard, then you will need to prepare for a dispute. Preparing for a dispute is something to be done at the start of the tenancy – as afterwards could be too late.

As part of the inventory and check-in process, don’t simply mark down what items are there – also mention the age and condition of the item, remembering to include the features of the property itself such as walls, skirting boards, doors, etc. For example, you may describe your living room as follows:

As you can see, this clearly lays out what state the property is in at the start of the tenancy. If at the end of the tenancy the check-out report stated that the walls were dented and the paint was chipped beyond wear and tear, you would be able to show a clear deterioration in condition.

There are many things you can do to try and protect your property. The following are only suggestions and the list is not exhaustive.

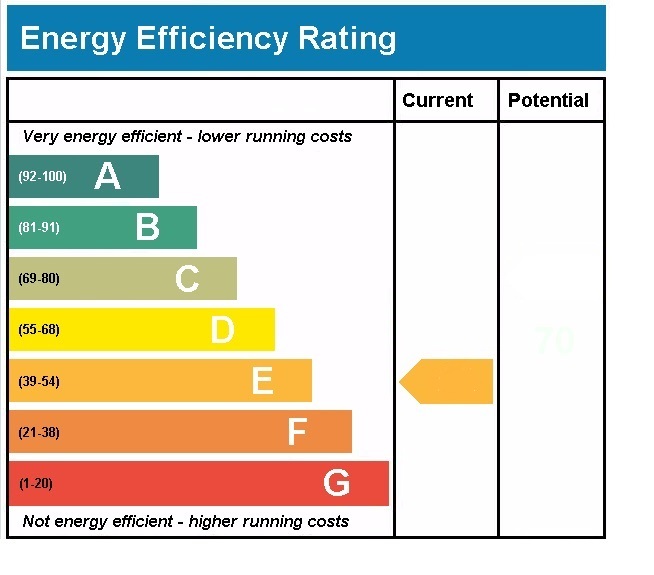

The Department for Business, Energy and Industrial Strategy has released guidance to landlords of privately rented non-domestic property on complying with the 2018 ‘minimum level of energy efficiency’ standard (EPC band E).

The Energy Efficiency (Private Rented Property)(England and Wales) Regulations 2015 mean that, from April 2018, private non-domestic (and domestic) landlords must ensure that properties they rent in England and Wales reach at least an EPC rating of E before granting a tenancy to new or existing tenants.

The document provides guidance and advice on: